Susan Ferrechio of the Washington Examiner reports negative reaction to a plan to give the IRS more access to people’s personal information.

Congressional Democrats, concerned over lukewarm public enthusiasm for their massive social welfare spending package, may be forced to modify a tax-raising provision that has prompted a significant backlash.

A plan to provide the IRS with access to individual bank accounts with balances as low as $600 may end up significantly modified or even dropped altogether amid opposition from lawmakers and trade groups who say it would infringe on privacy and create significant liability for financial institutions as well as add new costs for consumers.

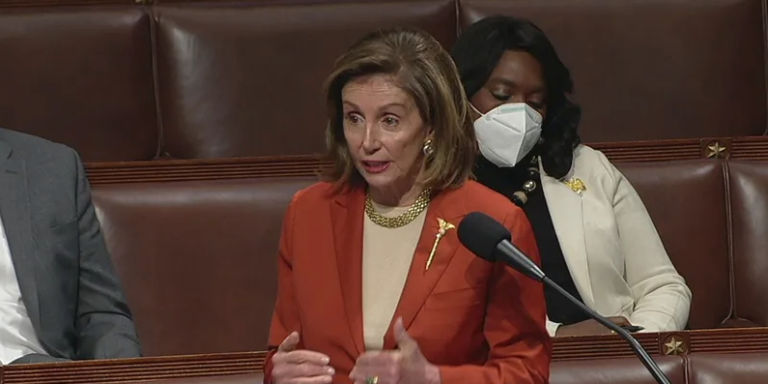

Speaker Nancy Pelosi, a California Democrat, brushed off concerns about the provision when reporters asked about it on Tuesday but acknowledged the terms could change.

“Yes, there are concerns that some people have,” Pelosi said. “But if people are breaking the law and not paying their taxes, one way to track them is through the banking measure.”

As for the $600 threshold, she added, “that’s a negotiation that will go on, as to what the amount is.”

The provision could backfire for Democrats who are struggling to increase public approval of the Build Back Better plan.

The massive social welfare package Democrats hope to jam through the House and Senate this year would create a broad array of new government programs, paid for with tax increases.

Democrats say the tax hikes would be aimed only at corporations and wealthy individuals, who President Joe Biden has long promised would not include families with incomes less than $400,000.

But the IRS provision would target just about anyone with a bank account, requiring financial institutions “to track and submit to the IRS information on the inflows and outflows of every account above … $600 during the year, including breakdowns for cash,” the American Bankers Association said.