Christopher Jacobs writes at the Federalist about a little-known element of congressional Democrats’ tax plans.

For a party that purportedly wants to “tax the rich,” Democrats sure have a funny way of showing it.

Bloomberg reported on Friday that a potential repeal of the cap for state and local taxes—the SALT cap, to use Washington nomenclature—would erase most of the tax increases included in the House’s version of the $3.5 trillion spending bill being considered by Congress. In some cases, relatively affluent families could actually see a tax cut.

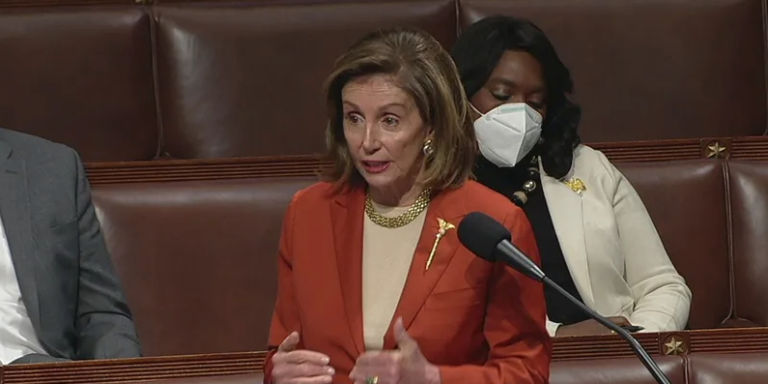

It’s all part of Democrats’ scam to bail out blue states (again), and the union organizations that dominate same. Lawmakers in these blue states—California liberals like House Speaker Nancy Pelosi (D-CA)—want working-class families in red states like Florida and Texas to subsidize residents making $200,000, $400,000, or more in places like New York and New Jersey.

The tax relief package that passed under President Trump capped the federal deduction for state and local taxes paid at $10,000, an amount not indexed for inflation in future years. For many residents of red states, which may not have an income tax and keep property taxes relatively low, their state and local taxes paid remain below $10,000, meaning the cap had no effect on their tax situation.

The SALT deduction also only applies to taxpayers who itemize their deduction. Given that the doubling of the standard deduction in the 2017 bill sharply reduced the number of people who itemized, that factor also reduced its impact, particularly for households of modest incomes.

But in states with high property taxes—read: New York, New Jersey, and California—and states with high income taxes—read: New York, New Jersey, and California—capping total SALT deductions at $10,000 per year could lead to a large increase in some households’ federal taxes.