If you’re someone who carefully monitors your monthly spending, you’ve witnessed prices going up on a variety of goods, from gas and lumber to staple products like corn and coffee. I don’t know which is worse, last year’s Clorox wipe shortage or today’s coffee bean prices. Thoughts and prayers appreciated.

The Consumer Price Index (CPI), which is a tool that helps economists gauge how much the average American household is paying for essential goods, rose 4.2% last month compared to April of 2020. The numbers were even less rosy for the South, with our region experiencing a 4.4% increase in prices over the past year. According to CNBC, “The increase in the annual headline CPI rate was the fastest since September 2008, while the monthly gain in core inflation was the largest since 1981.”

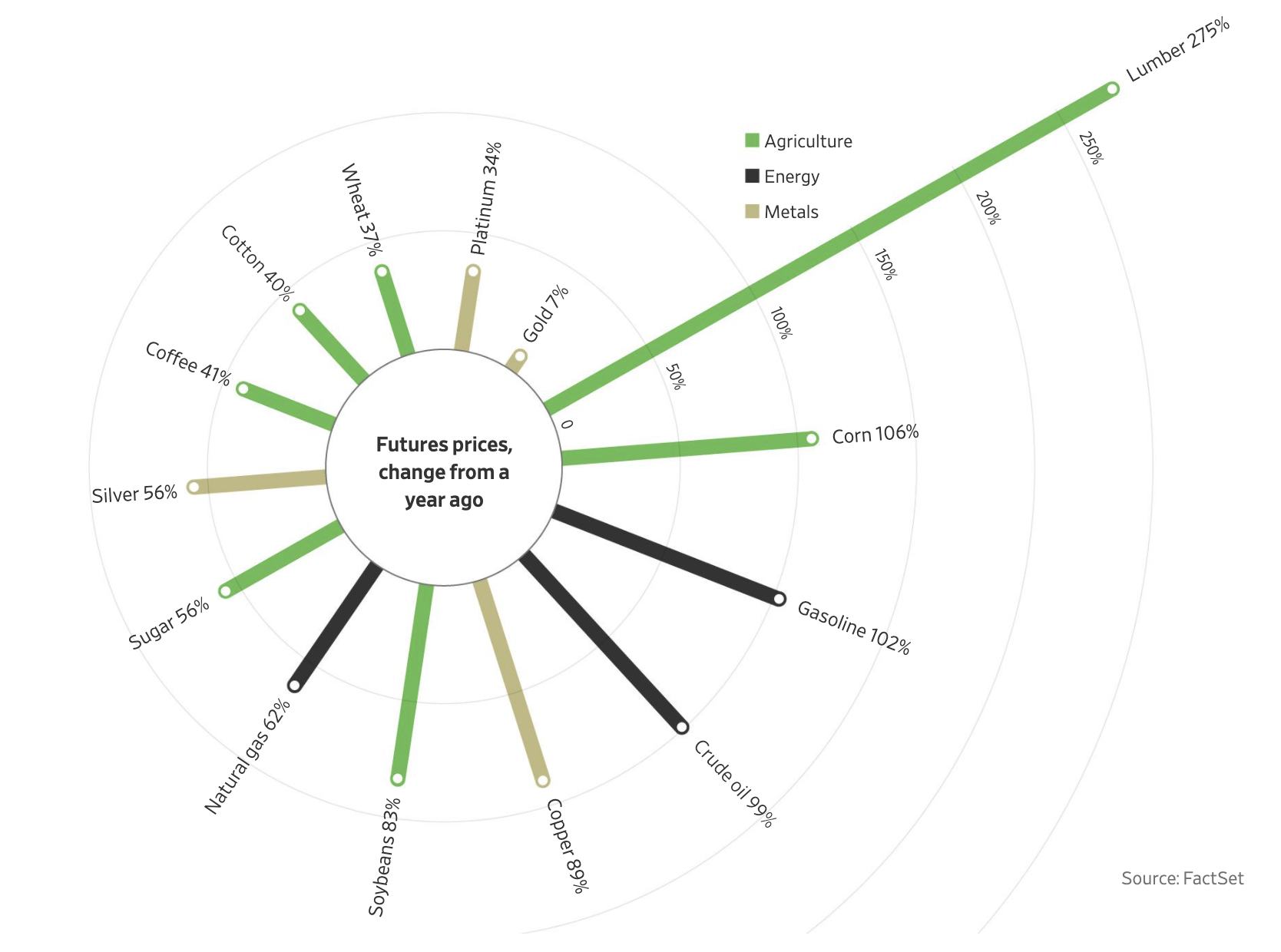

So, where are we seeing the greatest increase in cost for Americans? As this Wheel of Misfortune below indicates, the cost of lumber is through the roof, with futures prices increasing by 275%. Alas, the rising cost of home prices reflects this reality. Wall Street Journal also notes that the cost of copper, an essential metal used in homes and electronics is at an all-time high. Corn, gasoline, and crude oil futures are also especially high.

What’s causing these costly woes? There are numerous factors, not the least of which is that significant portions of our economy were stress tested in unimaginably difficult ways over the past 15 months. Couple that with historic government printing and spending and then throw in a blocked Suez Canal–just for fun!–and you have extremely challenging circumstances. And that’s really just the tip of the iceberg (or the sand off the Suez, if you prefer).

Beyond discerning the numerous causes of our current state of inflation, is the trillion dollar question: “How long will this last?” Economist Michael Strain offers a few tells that will indicate whether this is a bout of transitory inflation–here today, but gone very soon–or persistent inflation a la Jimmy Carter era.

Writing for Bloomberg, Strain notes that persistent inflation will:

- Keep consumer prices elevated for several months, not just a singular “bad” month

- Continue to drive up wages, which will place pressure on businesses to increase prices in order to pay and retain employees

- Make investors uneasy, which will increase market volatility, and likely put the Fed in a challenging position

Let’s hope that inflation quickly deflates and our economic recovery continues to move forward with promise. In the meantime, if you really want to show your dad you love him this Father’s Day, perhaps consider purchasing him a plank or two of lumber.