The full picture for 2019 income taxes is now available, but it does not provide much clarity about the revenue picture for the rest of FY2020-21. The latest General Fund Monthly Report from the Office of the State Controller includes the final income tax payments delayed from April.

Personal income tax payments for July totaled $1.87 billion, nearly double last year’s $974 million. Corporate income tax revenue was $170 million, compared to last year’s $17.6 million.

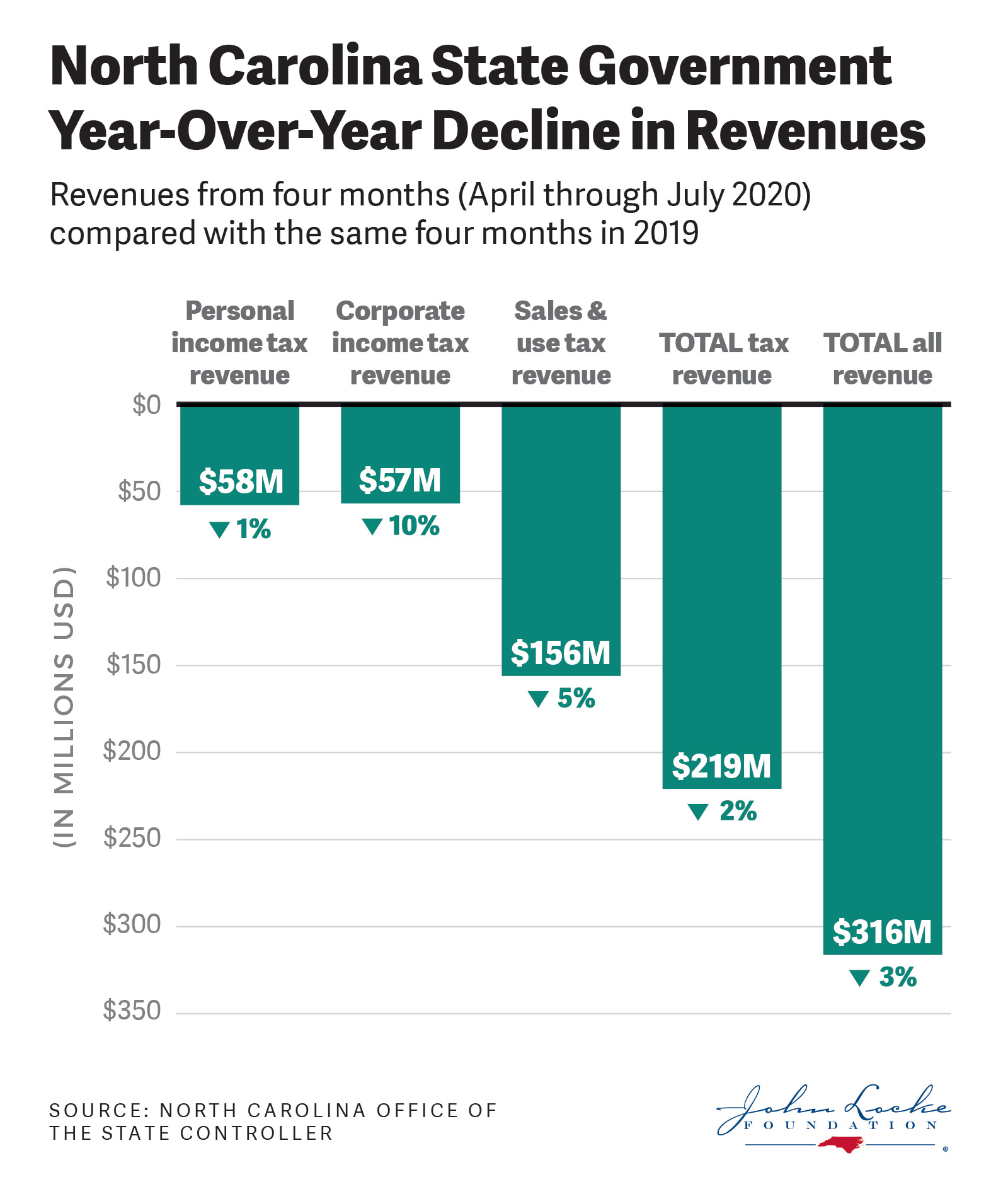

Looking at the four months from April through July 2020 vs the same months last year

Looking at the four months from April through July 2020 vs the same months last year

- Personal income tax revenue -1% (-$58 million)

- Corporate income tax revenue -10% (-$57 million)

- Sales & use tax revenue -5% (-$156 million)

- TOTAL tax revenue -2% (-$219 million)

- TOTAL revenue -3% (-$316 million)

Despite the year-over-year declines, revenues remain nearly $900 million higher than the same four months in 2018. It is hard to know how much the sales tax was boosted by unemployment benefits and CARES Act payments to families. That is why the August and September revenue reports are so important for the General Assembly to finalize a budget for the current fiscal year.