An exhibit from the official audit of the economic impact of the Georgia Film Tax Credit

An exhibit from the official audit of the economic impact of the Georgia Film Tax Credit

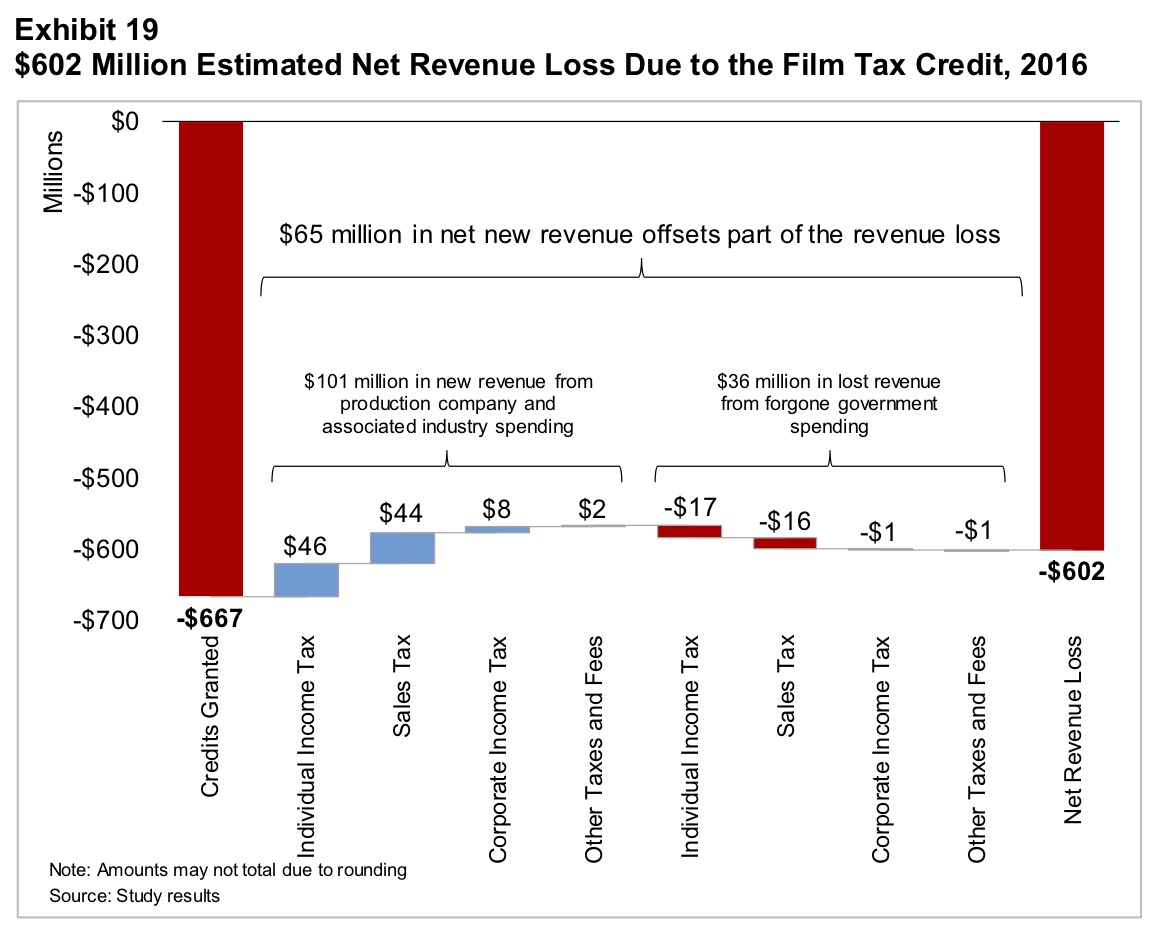

My last post pointed out a problem in the assumptions used in the audit of Georgia’s film tax credit that meant it was still overestimating its economic impact. The audit assumed that all economic activity related to the film industry owed to the film tax credit. That fundamental flaw alone means that the economic impact of the tax credit is considerably lower than the audit’s estimate of $2.8 million.

In this post, I will discuss another assumption in the audit that inflates the estimated economic impact

Applying opportunity costs only to government spending choices

The audit rightly criticizes Georgia Department of Economic Development for using an economic-impact multiplier of 3.57 “without a clear source of the multiplier or evidence of its accuracy.” Instead, the audit relies on IMPLAN economic impact modeling that has significant flaws of its own, which we’ve frequently discussed. The audit winds up using a multiplier of 1.84.

The problem is, as we’ve discussed here, models such as IMPLAN’s assume only positive returns on government spending. The audit even states so explicitly on page 18:

The General Assembly could have chosen other ways to spend the forgone revenue resulting from the credit. However, any expenditure would have resulted in a positive economic impact to the state, including additional labor and jobs.

But that’s not the case at all. Taken to its extreme, such thinking would have citizens placed in permanent wardships, saved from making inefficient economic decisions of their money by all-wise government planners. It ignores the reality that government revenue comes from taxpayers, whose own expenditures of that money would not only have added up to positive economic impact, but it would have served the taxpayers’ interests more directly (by virtue of it being their decisions, in light of their knowing their own needs, rather than used by government for something else less desirable).

In 2018 I wrote about the Georgia Film Office’s multiplier in comparison with IMPLAN multipliers:

It’s hard to believe, but Georgia uses an even shoddier system of projecting economic impact than off-the-shelf, proprietary input-output (I-O) modeling software like IMPLAN. With no accounting for opportunity costs built into the I-O model, the multiplier can only be greater than one. Any endeavor examined in such a way will report out to be a surefire moneymaker. How much depends on the size of the multiplier chosen.

Politifact Georgia reports that the standard IMPLAN multiplier for the film industry is 1.83. Scott Lindall, one of the original developers of IMPLAN, told Twin Cities Business that, in general, “you don’t see output multipliers over about 1.3 to 1.8.” Since 1973, however, Georgia has assumed twice the “impact” without even being able to say why.

(For a detailed discussion of multipliers and the problems with using input-output models like IMPLAN to project economic impact, see Dr. Roy Cordato’s report, “Economic Impact Studies: The Missing Ingredient Is Economics.”)

We have criticized economic impact studies for ignoring opportunity costs altogether. This audit does attempt to address that flaw in IMPLAN modeling. How? By using IMPLAN modeling to estimate how much economic benefit was forgone by not having tax revenue used for education and health care.

But for tax revenues, opportunity costs to the state economy of a state government budgeting decision isn’t really the lost alternative budgeting decision. It’s all the taxpayers’ lost alternative choices for their portions of the money if the government hadn’t taken those resources from them by coercive force.

As Cordato explained in his report on economic-impact studies:

Every dollar that is spent as these “impacts” occur and every resource that is used, including labor, has an unseen opportunity cost. Starting with the original $20 million [in his government spending example], the question is simple: What economic activities would have occurred if that money remained in the hands of the taxpayer? It would have been spent on various goods and services or saved in local banks and therefore would have had an economic impact that would also have had secondary effects associated with it. This would have to be subtracted from the visible effects.

The audit’s accounting for the lost government use of the tax credits doesn’t ask what economic activities would have occurred if the money was directed by individual taxpayers to whom it originally belonged. It assumes that their money is directed by government at no cost to the state economy.

Summing it up

The economic impact of Georgia’s film tax credits in 2016 certainly wasn’t $7 billion. It also wasn’t $2.8 billion, either. To be otherwise, the following must all be true:

- all film production and film-related activity existed in Georgia only because of the tax credit

- the tax credit was at the optimal level to incentivize film production without overpayment

- Georgia budget writers know better than Georgia citizens how to spend their money

Instead, any positive economic impact of Georgia’s film tax credits is likely a mere fraction of $2.8 billion. The Georgia film tax credit is a giveaway program with shockingly little oversight that hurts, not helps, the Georgia economy on net, even if it does benefit some Georgians along with outside production companies.