Thought the performance audit of the administration of Georgia’s film tax credit program was brutal enough? The Georgia Office of Audits and Accounts also, however, conducted a performance audit of the economic impact of Georgia’s film tax credit program.

Georgia had infamously resisted reviewing their own film incentives, letting the Georgia Department of Economic Development tout ridiculous economic-impact numbers based on made-up multipliers and other people’s willingness to believe. They’ve wowed media as well as politicians, lobbyists, economic development types, and film incentives proponents in other states, including North Carolina. They also inadvertently provided phony leverage to Hollywood activists who wanted to influence Georgia state policy.

Economists have remained skeptical, as the research literature on film incentives (as with other incentives) has been unsupportive of the incentives as a way to do much other than enrich the out-of-state production companies awarded the incentives. Research shows they have limited ability even to boost just the state’s film industry without respect for the overall economy.

Losing 90 cents on the dollar

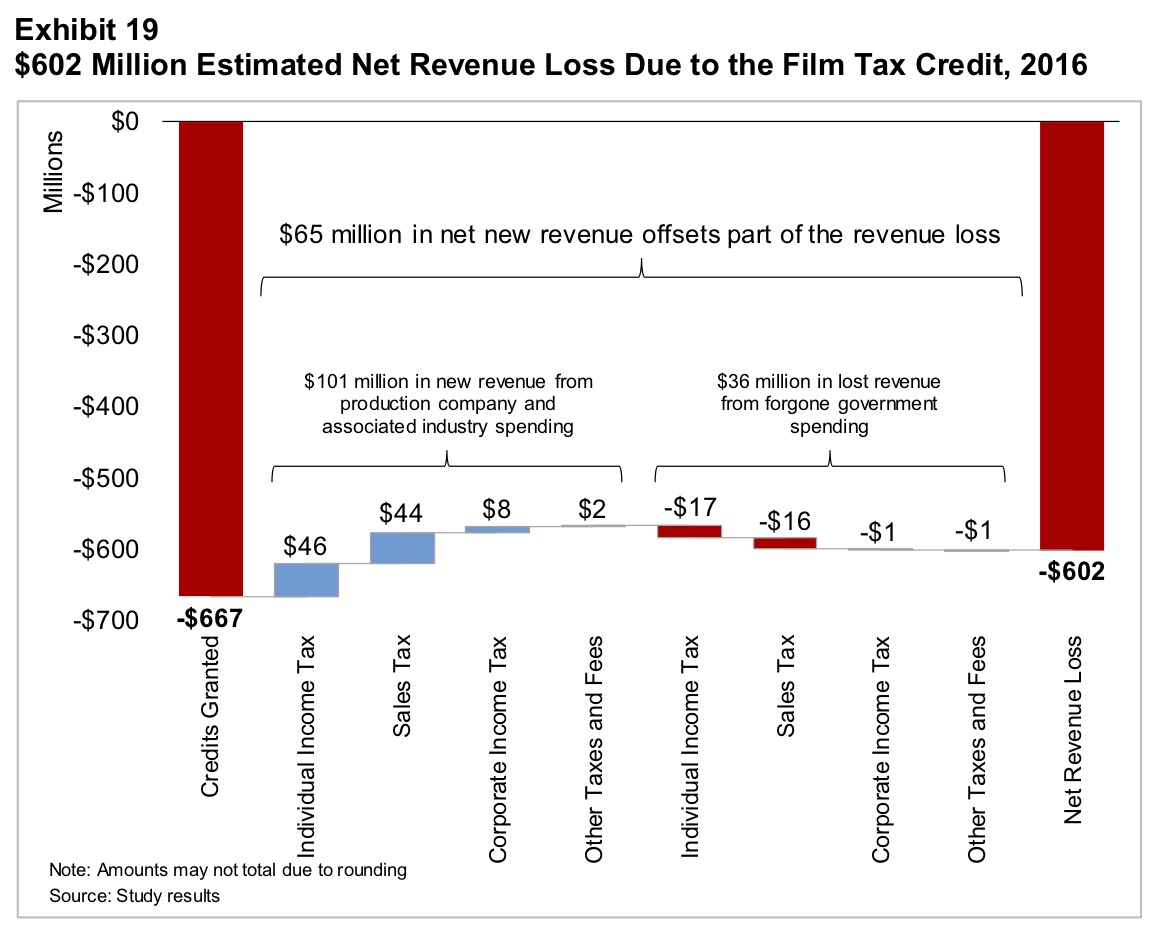

The big finding is that Georgia’s film incentive returned only 10 cents per dollar of tax credit given. In 2016 Georgia granted $667 million in tax credits for film productions. In return, Georgia realized only $65 million in net new revenue, meaning the state self-inflicted a net revenue loss of $602 million:

The economic activity generated by the film tax credit does not generate sufficient additional revenue to offset the credit, even after considering tourism and studio construction. In 2016, the film tax credit resulted in a net revenue loss to the state estimated at $602 million. The state’s return on investment for the credit was 10 cents for each dollar, though local governments received an additional return of 11 cents in revenue.

Here’s a graph from the audit detailing this piddling return on investment:

An exhibit from the official audit of the economic impact of the Georgia Film Tax Credit

An exhibit from the official audit of the economic impact of the Georgia Film Tax Credit

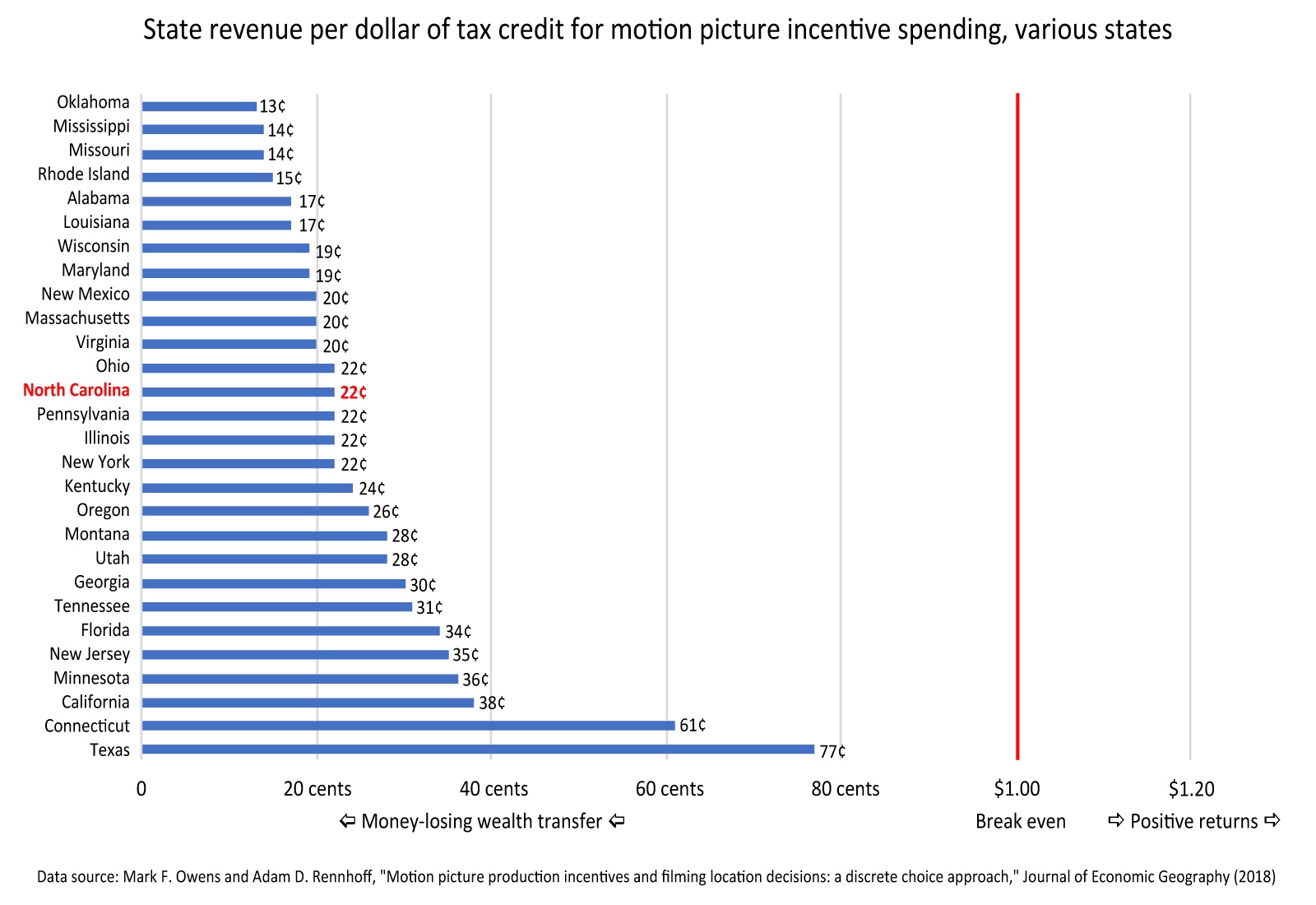

Rather than revealing a “Movie Miracle,” this finding is consistent with other state studies of their film incentives programs. It’s also consistent with findings in a 2017 study published by the Journal of Economic Geography by economists Mark F. Owens of Penn State University and Adam D. Rennhoff of Middle Tennessee State University. Here’s a chart I made from their findings:

Note: At 30 cents per dollar, Owens and Rennhoff’s estimate for Georgia’s return on investment was less pessimistic than the auditing office’s.