The Hollywood Reporter is the latest publication to fall for bogus numbers from Georgia on the economic impact of its film tax incentives program.

This gullibility is on display in an article about efforts in California, Illinois, and New York to “poach” Georgia’ film industry. This effort comes in response to certain actors, directors, and film companies vowing to boycott Georgia over the new state law banning abortion in cases in which an unborn baby’s heartbeat can be detected.

A $9.5 billion industry hangs in the balance ahead of a potentially “crippling” boycott over an abortion law as California, Illinois and New? York entice producers to yank the state’s 455 productions for a less hostile environment.

Set aside how bizarre the term “hostile environment” is in this context (trying to be especially sure human lives aren’t taken unnecessarily is surely the cardinal opposite). On what basis does THR have it that Georgia’s film industry is worth $9.5 billion?

Last year I looked into what was being called “Georgia’s movie miracle” and found a bunch of nonsense. And it wasn’t even regular economic-development nonsense, using plug-‘n’-play software to generate an impact report with huge numbers with no understanding of opportunity costs.

No, Georgia just uses a made-up multiplier — the same one since 1973. As I found:

That’s not what the film office does, however. Instead, it simply takes the amount of spending reporting by film production companies in Georgia and multiplies it by 3.57. That’s how it arrives at the “economic impact” number. Really.

Where does that 3.57 multiplier come from? The answer is: We don’t know, but we’ve been doing it this way since 1973.

Kid you not. Lee Thomas, head of the film office, told Politifact Georgia, “the state doesn’t know what sorts of spending that multiplier originally counted, or why the 3.57 estimate was used. But keeping the same multiplier allows to track progress over time, comparing apples to apples, she said.”

The Atlanta Business Chronicle reported that “Thomas said it’s the same formula the film office has used since it opened in 1973.”

Don’t Georgia officials question these things? Well, no, apparently:

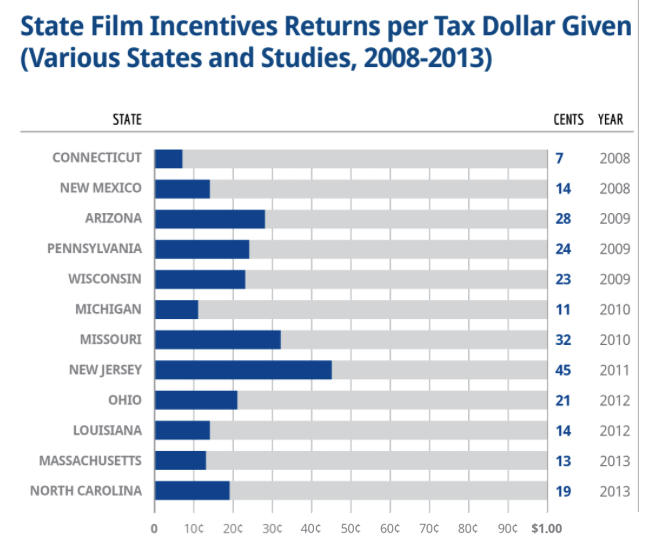

Unlike many other states with programs to incentive film productions within their borders, Georgia has avoided rigorous review of its program. In May 2017, Pew Charitable Trusts released a report that identified Georgia as a “trailing” state in evaluating tax incentives. The report noted that although Georgia has one of the most generous program in the country, “Georgia lacks a process for evaluating the film tax credit and other incentives.”

Those other states think they’re going to reap $9.5 billion in economic activity if they successfully poach all of Georgia’s film industry? Good luck. But first, you’re going to have to poach Georgia’s lackadaisical approach to evaluating government incentives and its special, made-up, vintage 1973 multiplier.