Medicare Annual Report

The Board of Trustees for Medicare, America’s health insurance program for those 65 and older, produce an annual report on the financial operations of the program. For the second straight year, the Trustees project that under current spending, the Hospital Insurance Trust Fund, or Medicare Part A will be depleted by 2026:

In 2018, HI expenditures exceeded income by $1.6 billion. The Trustees project deficits in all future years until the trust fund becomes depleted in 2026. The assets were $200.4 billion at the beginning of 2019, representing about 62 percent of expenditures during the year, which is below the Trustees’ minimum recommended level of 100 percent. The HI trust fund has not met the Trustees’ formal test of short-range financial adequacy since 2003. Growth in HI expenditures has averaged 3.0 percent annually over the last 5 years, compared with non-interest income growth of 4.4 percent. Over the next 5 years, projected annual growth rates for expenditures and non-interest income are 7.0 percent and 5.7 percent, respectively.

Given the state of the federal budget, which is projected to run an $897 billion deficit this year, Congress and the winner of the 2020 Presidential election will face tough decisions in the years to come for how to deal with this issue.

Opting out of Medicare

The bleak Medicare Trustees report raises other questions about Medicare-eligible seniors and their healthcare choices. What if someone wishes not to enroll in Medicare?

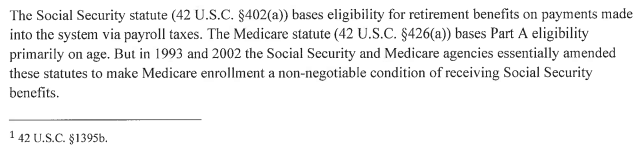

Did you know that under current law, a condition to receive Social Security benefits is enrollment in Medicare Part A? This means that someone may risk the loss of Social Security benefits if they fail to enroll in Medicare Part A upon turning 65.

Statutorily, Medicare is a voluntary program. Up until the 1990s and early 2000s, there was no administrative requirement of Medicare Part A and Social Security benefits:

There are several reasons one may choose not to enroll in Medicare such as religious or philosophical objections or the intention to retain or purchase private health insurance. Seniors should have the freedom to choose their healthcare coverage without fear of losing Social Security benefits.

Executive and Legislative Options

In November, I signed on to a letter with several other organizations to encourage the President to address this by executive action.

In addition to this proposal, U.S. Senators Ted Cruz (R-TX), Rand Paul (R-KY), and Mike Lee (R-UT) have introduced the Retirement Freedom Act that would accomplish the same goal through legislative action.

Regardless of the method, the U.S. government should remove the condition that Seniors must enroll in Medicare Part A to receive Social Security benefit as this limits the choice of seniors and locks them into government healthcare that may not suit their health needs best.