Counties that voted for Donald Trump will not lose as many tax breaks as those that voted for Hillary Clinton. This is visible among some of the surprising similarities and differences the Wall Street Journal found in the effects of federal tax reform on Trump counties and Clinton Counties.

Counties that Hillary Clinton won by 25 percent or more had average incomes $24,000 higher than counties Donald Trump won by 25 percent or more. Those counties have high state and local taxes. A third of voters in Clinton counties claim on average $17,000 in state and local deductions. Less than a quarter of voters in Trump counties took the deduction worth an average $7,900. Clinton counties also had larger percentages of people taking larger deductions for mortgage interest payments and charitable contributions.

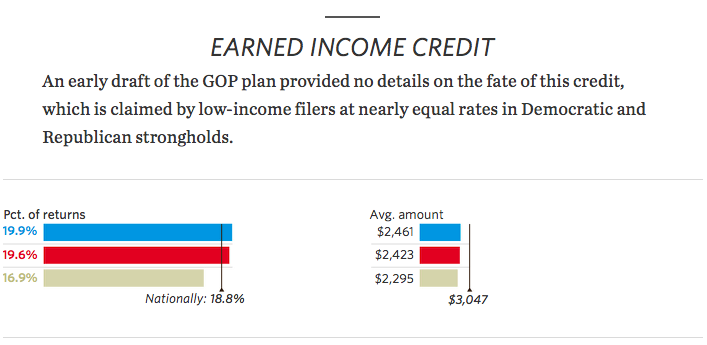

Trump counties were more likely to take the child tax credit, but similar percentages took the earned income tax credit for similar amounts.