William Cohan’s cover story in the latest Barron’s focuses on avoiding potential pitfalls while rolling back banking regulations.

William Cohan’s cover story in the latest Barron’s focuses on avoiding potential pitfalls while rolling back banking regulations.

Regulatory relief for the country’s big banks may soon be on the way—and not a moment too soon.

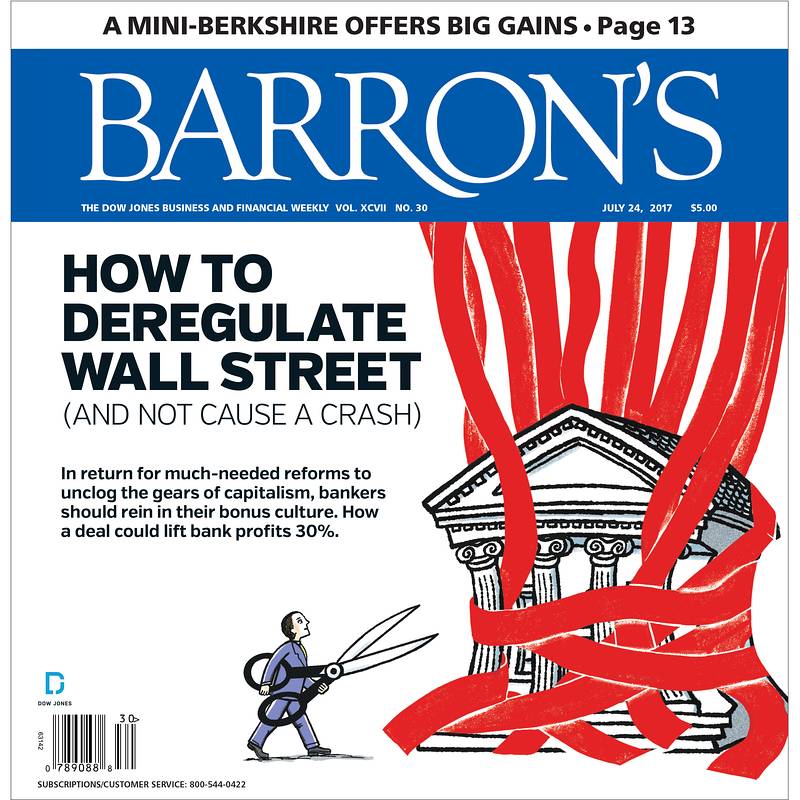

For seven years, the unintended consequences of the Wall Street Reform and Consumer Protection Act have clogged the gears of capitalism. Colloquially known as Dodd-Frank, the bill was designed to ensure that big banks would never again trigger a financial crisis. But the law’s 848 pages and the 22,000 or so additional pages of related rules and regulations have created a crisis of their own.

The more onerous provisions effectively restrict bank lending and reduce financial-market liquidity, creating a drag on U.S. economic growth, which has slogged along at about 2% a year—what Harvard University economist Larry Summers has termed “secular stagnation.”

The promise of Donald Trump and his economic advisors and a Republican Congress is that loosening the restrictions on Wall Street and other banks will unleash long-hibernating animal spirits and jolt the nation’s gross-domestic-product growth into a higher trajectory. …

… To ease up on regulatory speed limits without causing another economic calamity, Trump should strike a grand bargain with Wall Street. In exchange for the smarter regulation that the banking industry seeks, and seems on the verge of getting, he should insist that Wall Street adhere to several postcrisis rules, including those that require higher bank capital and reduced balance-sheet leverage and that require derivatives to be traded on exchanges where their prices can be determined more easily. And, as part of the grand bargain, Trump should also insist that Wall Street reform its outdated compensation system, which rewards bankers, traders, and executives for taking big risks with other people’s money, but fails to hold them accountable when things go wrong, as happened in 2008.