BB&T has announced for the second time this month that it will be acquiring new branches and expanding the bank’s footprint in the United States. Last week, BB&T announced ti would buy 41 branches in Texas from Citibank and this week it announced it is going to purchase The Bank of Kentucky and acquire 32 new branches, 31 in Kentucky and 1 in Ohio.

BB&T Corp. CEO Kelly King said Monday the Winston-Salem lender has agreed to purchase a Kentucky bank, a move that allows it to enter the Cincinnati market.

In an interview with the Observer, King also said he expects BB&T will add to its employee and branch count in the Charlotte metropolitan area over time, although he provided no specifics.

BB&T, the third-largest lender by deposits in the Charlotte region, announced it has signed an agreement to acquire The Bank of Kentucky for about $363 million in stock and cash.

Regulators and Bank of Kentucky shareholders still must approve the deal, which is expected to close in the first half of next year.

The acquisition gives BB&T 31 branches in northern Kentucky and one in Ohio, BB&T’s first branch in that state.

The deal marks BB&T’s first acquisition of another lender since it acquired Florida’s BankAtlantic in 2012.

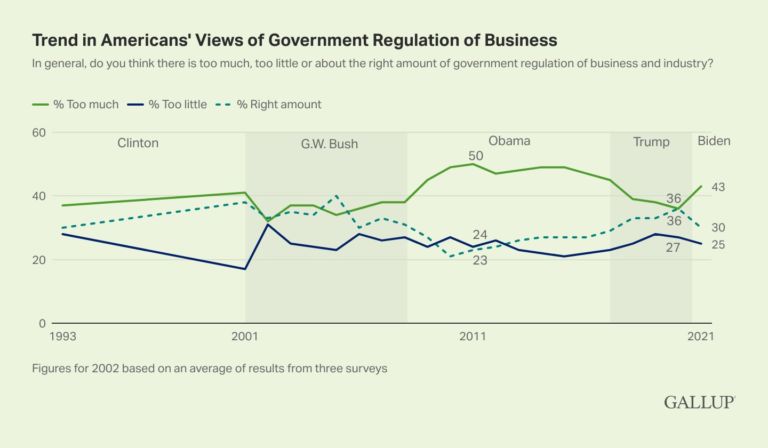

King said regulations put into effect since the financial crisis, such as those under the Dodd-Frank Act, have held back merger and acquisition activity in the banking industry. Now, he said, “the sellers are ready to talk.”

On Monday, King said BB&T has no plans to close branches in the Charlotte metro area, where it has roughly 1,900 employees across various business lines and about 70 branches.“We would absolutely expect our bank to be expanding in the greater Charlotte market, not contracting.”

He said he did not have estimates for how many branches or employees the bank might add to the Charlotte region.

BB&T shares fell less than 1 percent on Monday to $37.50.