The latest Barron’s cover story gives North Carolina relatively good marks in terms of its ability to meet its financial obligations (including long-term obligations such as government pensions). As Andrew Bary reports:

The latest Barron’s cover story gives North Carolina relatively good marks in terms of its ability to meet its financial obligations (including long-term obligations such as government pensions). As Andrew Bary reports:

State and local governments face problems with unfunded pension and health-care obligations, but their total financial obligations generally look manageable, when measured against revenue, personal income, and the size of state economies. …

… The fiscal situation at the states continues to improve with only a few exceptions — notably Illinois, which is grappling with an enormous unfunded pension obligation that Eaton Vance puts at $143 billion.

STATE AND LOCAL TAX REVENUE has risen for 15 straight quarters, and nearly every state has implemented pension reforms that include reduced cost-of-living increases, greater employee contributions, and changes to benefit calculations. …

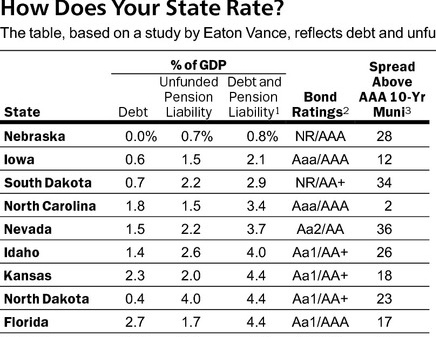

… Using a measure that reflects debt and unfunded pensions, Nebraska comes out on top, followed by Iowa, South Dakota, and North Carolina. At the bottom of the list are Connecticut, Illinois, Hawaii, and Alaska. …

… States also are on the hook for $627 billion of unfunded retiree health-care liabilities, according to the Pew Center for the States, which based its analysis on 2010 data. The states’ health-care obligations are only 5% funded. Many, including California, New York, and Texas, have set aside little or nothing for future employee health-care liabilities; they simply pay these expenses as incurred.

The states that score highest in the Eaton Vance rankings, Nebraska, Iowa, South Dakota, North Carolina, and Nevada, had little debt and low pension obligations.