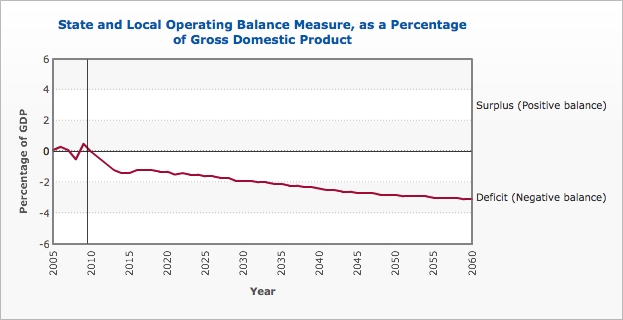

The Government Accountability Office (GAO) released their April update to the State and Local Governments’ Fiscal Outlook publication. Here is the bottom line:

They conclude, “The model’s base case simulations show that the fiscal position of the sector will steadily decline through 2060 absent any policy changes.” (p. 1) Why?

The GAO researchers argue that Medicaid and government employee/retiree health benefits will pummel state and local budgets over the next 50 years. They write,

In the long term, the decline in the sector’s operating balance is primarily driven by the rising health-related costs of state and local expenditures on Medicaid and the cost of health care compensation for state and local government employees and retirees. Since most state and local governments are required to balance their operating budgets, the declining fiscal conditions shown in our simulations suggest that the sector would need to make substantial policy changes to avoid growing fiscal imbalances in the future. That is, absent any intervention or policy changes, state and local governments would face an increasing gap between receipts and expenditures in the coming years. (p. 2)

According to GAO models, closing the gap would require a 13 percent tax increase, a similar decrease in spending, or a combination of the two.