In the second installment of its new “Saving America” series (the “Locker Room” highlighted part one here), Barron’s calls for a cut in the U.S. corporate tax rate. Gene Epstein explains why.

In the second installment of its new “Saving America” series (the “Locker Room” highlighted part one here), Barron’s calls for a cut in the U.S. corporate tax rate. Gene Epstein explains why.

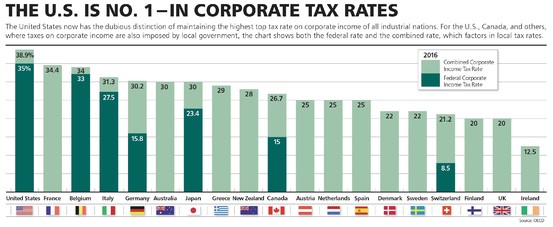

If President-elect Donald J. Trump and the new Congress are serious about firing up the U.S. economy, they will move swiftly to cut the corporate tax rate, now the highest in the world.

That one step would have far-reaching effects. It would make American businesses more competitive in the global arena. It would reduce the massive amounts of time and energy now wasted on tax-avoidance maneuvers. And it would bring home to these shores trillions of dollars of profits earned by U.S. corporations overseas and now housed in kinder tax jurisdictions.

Trump seems to appreciate all of that. On the campaign trail, he proposed slashing the rate that businesses pay on income from 35% to 15%. That might be too much—it could significantly reduce the government’s tax haul and add to the nation’s already unacceptable debt burden. Barron’s recommends a cut to 22%, which would be revenue-neutral, allowing businesses to produce just enough additional taxable income to offset the effect of the lower rate. And getting a 22% cut through Congress would be easier than 15%.

THE IDEA OF A revenue-neutral cut in the corporate income tax harks back to 1978, when economist Arthur Laffer was first cited as arguing that some tax cuts could generate enough added economic growth that the government would not lose revenue over the long term. Laffer also noted that most tax hikes generate less revenue than a conventional “static” analysis indicates, and most tax cuts lose less.

Laffer’s “dynamic” analysis covers all of the behavioral changes likely to result from a cut. To begin with, if the tax collector claims a lower share of income, there is an incentive to produce more income. Second, a lower rate means there’s less incentive to spend time and effort avoiding the tax.

That second factor—less tax avoidance—applies with special force to a rollback in the corporate income tax.