Gene Epstein offers Barron’s readers an optimistic take on the year ahead.

Is the U.S. economy going through a growth pause, or is this the pause before the onset of recession? The answer to that question highlights two quite divergent outcomes for 2016—one good, one terrible. We subscribe to the former view. But before we make our case, let’s consider the bear argument.

If recession is imminent, then economic output will contract for an extended period, the stock market will continue to head south, and credit spreads will rapidly rise. The near-full-employment economy, signaled by January’s jobless rate of 4.9%, will quickly unravel and vault toward 6% within months.

But what if, as often happens, the indicators signaling recession are false alarms? Then, the generally quite favorable fundamentals at this stage in the expansion should dominate. Indeed, we expect economic growth to run at an annual rate of 2.8% through the first half of this year, then accelerate to 3.2% by the second half.

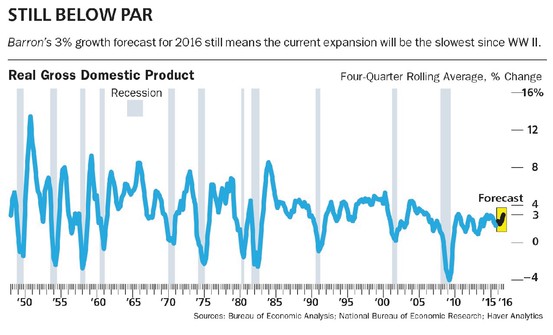

Growth of real economic output in 2016 would therefore come in at 3%, by the conventional fourth-quarter-over-fourth-quarter measure. This would make 2016 the best-performing calendar year since the expansion began in mid-2009. Under this scenario, the job market will continue to tighten, as the unemployment rate falls toward 4%. Credit spreads will narrow, and the stock market could rebound, probably touching new highs by the end of this year. The wild card: the presidential election (see Follow Up).

Our 3% outlook, while upbeat, isn’t off the charts. According to the Feb. 10 release from the monthly Blue Chip Economic Indicators, the consensus of 50 forecasters projects growth in 2016 at 2.4%. Blue Chip’s “optimistic” consensus of top 10 forecasts puts growth at 3% to 3.1%.

Of course, 3 percent growth sounds great only in relative terms.

To begin with, while a 3% increase in gross domestic product might sound unduly ambitious, this reflects only the lowered ambitions of the current era. Every expansion since World War II has gone through intervals of slow growth. However, all have had years in which economic growth ran at 4% or better, including the 2002-07 expansion. If the economy rises by 3% this year, the current expansion will still retain the dubious honor of being the weakest on record.