Peter Navarro, a University of California-Irvine business professor, focuses the latest Barron’s editorial commentary on China‘s military.

China’s factories are now rapidly producing military capabilities that will eventually rival those of the U.S. The only remaining debate is whether China will achieve parity by 2020, 2030, or later. …

… This rise of Chinese militarism portends tectonic shifts—economic, geographic, and political. It also means investors will win or lose fortunes.

Key portfolio decisions will range from the pricing and hedging of geopolitical risk to asset allocations across continents and countries. Bold traders will initiate Soros-style exchange-rate bets in anticipation of conflict-driven currency moves. The most opportunistic will tactically buy and short company stocks and country index funds around major conflict flashpoints. These range from China’s “renegade province” of Taiwan and a nuclearized North Korea, to the resource-rich but dangerous waters of the East and South China Seas.

A more sophisticated understanding of geopolitical risk will be an investor’s best friend in a 21st century of authoritarian aggression. Billions have already changed hands since Russia’s Ukraine adventures began in 2014. As the ruble has plunged and partly rebounded, German and U.S. bond prices have gyrated with flights to safety, and volatile European bourses have alternated between fear of reduced trade and hope of peace. A simple anticipatory short on an index fund for the Russian market would have netted a nearly 50% gain.

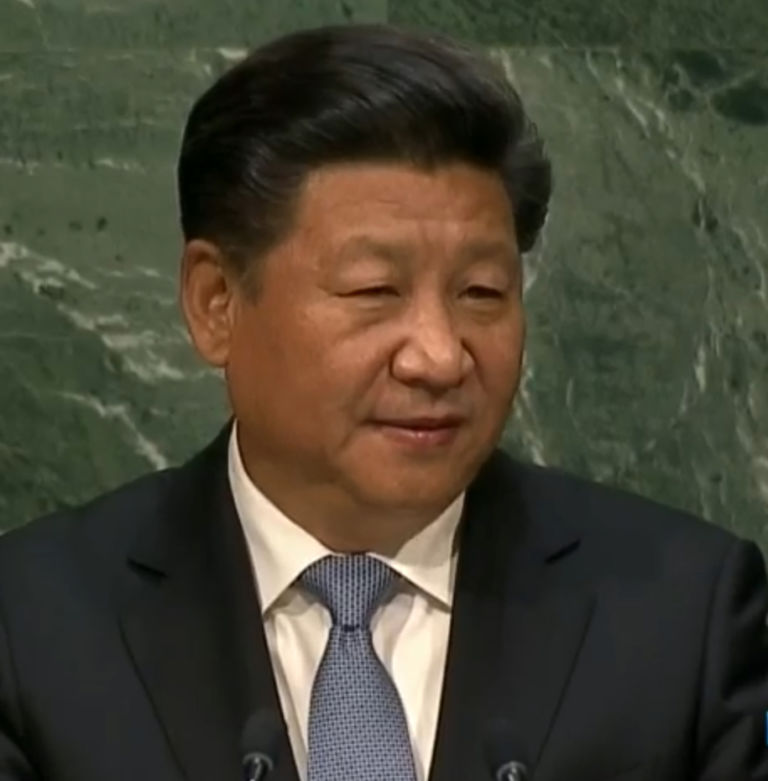

It is an open question whether a rapidly militarizing China will follow in Russia’s determined footsteps. While some still argue (or hope) for a “peaceful rise,” former Chinese leader Deng Xiaoping’s admonition to “seek truth from facts” quickly leads to a forecast of significant conflict.

Like Russia’s Vladimir Putin, China’s Xi Jinping is aggressively pursuing historical territorial claims unsupported by modern international law. China asserts sovereignty over 80% of the South China Sea–one of the most strategic sea lines of communication, through which a third of all shipping flows.