Obamacare’s Cadillac tax on fully loaded employer-sponsered health plans is meant to nudge businesses and their employees to be more cost-effective and cost-conscious when it comes to health care spending. Since the World War II era, employees have benefited from tax-free health insurance. Consequently, this tax advantage has induced the following behaviors:

- Employers substitute increases in taxable wages for overly generous coverage.

- Workers are shielded from the full cost of care which triggers overuse of medical services.

Yet the law’s 40 percent excise tax on the total amount exceeding plans that cost more than $10,200 per employee or $27,500 for a family ends up penalizing plans that are structured to promote cautious health care spending (like high deductible health plans combined with health savings accounts). Forbes contributor Sally Pipes explains:

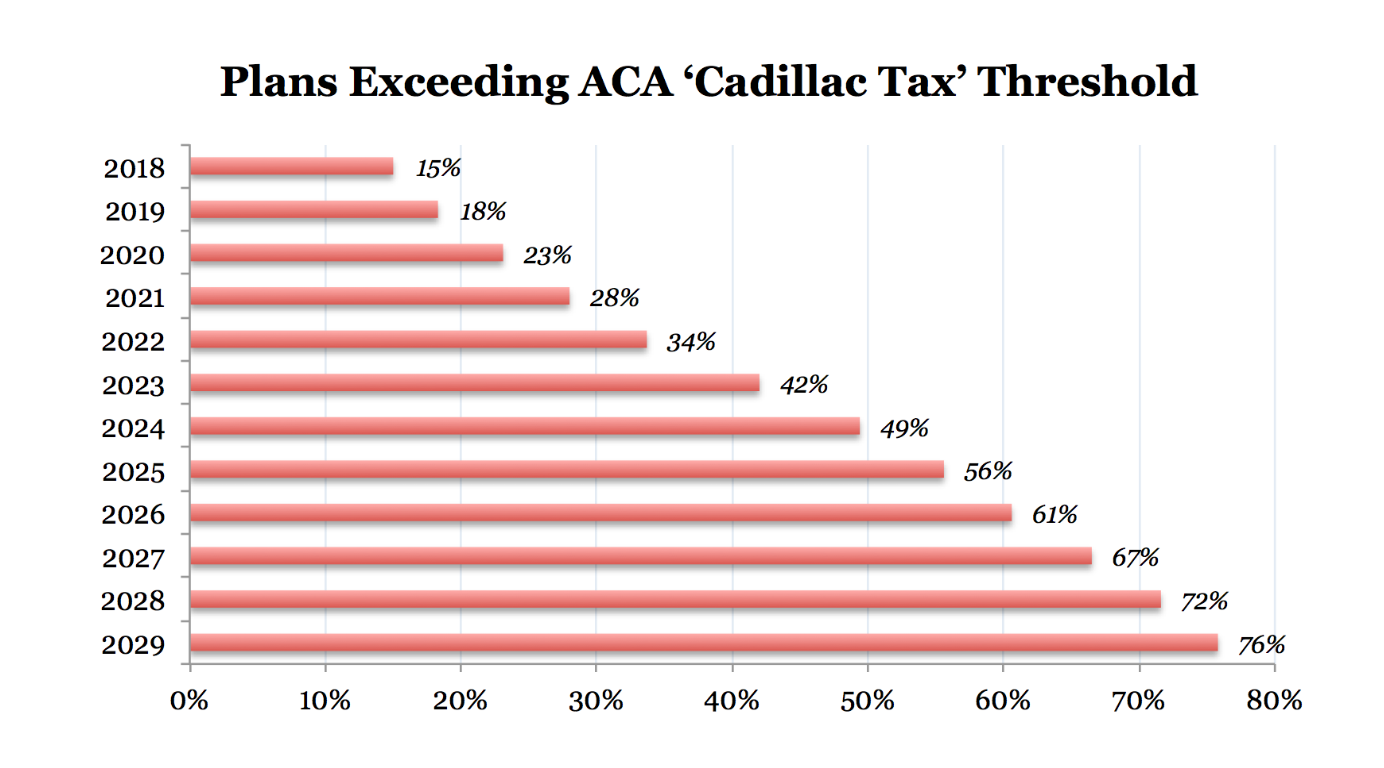

Making matters worse, the Cadillac tax doesn’t sufficiently account for medical inflation. Instead, the thresholds only grow at the rate of overall inflation plus 1 percent. That’s problematic because, in the past four years, employer premiums have surged an average of 5.2 percent a year — more than double the rate of general inflation.

In other words, more health plans will be considered “Cadillacs” every year. By 2030, the levy will ensnare the majority of Americans’ plans.

In essence, the ‘Caddy tax’ ends up penalizing the behavior it tries to promote. Pretty ironic.