As the General Assembly considers increasing lottery advertising and expanding games and venues, our friends at the Tax Foundation explain why the lottery is a tax and why the proposed expansion is a tax increase:

As the General Assembly considers increasing lottery advertising and expanding games and venues, our friends at the Tax Foundation explain why the lottery is a tax and why the proposed expansion is a tax increase:

While North Carolina legislators continue to negotiate a budget agreement (including possible tax changes), one provision is getting only a little bit of attention: a proposal to increase the percentage that the North Carolina Education Lottery can spend on advertising from 1 percent of gross sales to 1.5 percent. The Lottery timely released an announcement that the $2 billion in ticket sales this past fiscal year generated $522 million in revenue for the state, hinting that additional revenue (some $30 million) will come from boosted advertising.

The Lottery was set up ten years ago as a state enterprise to generate revenue for education programs. 50 percent of gross sales are paid out as prizes, 7 percent paid to retailers as a commission, 8 percent to pay for operations (including advertising, which cannot exceed 1 percent of total revenues), and 35 percent to the state for education funding. Additionally, winners pay income tax on their prizes. The odds are not great – table games in casinos have much better odds – but the Lottery has no real competition as it is state-sanctioned. Today only Alabama, Alaska, Hawaii, Mississippi, Nevada, and Utah have no state lottery.

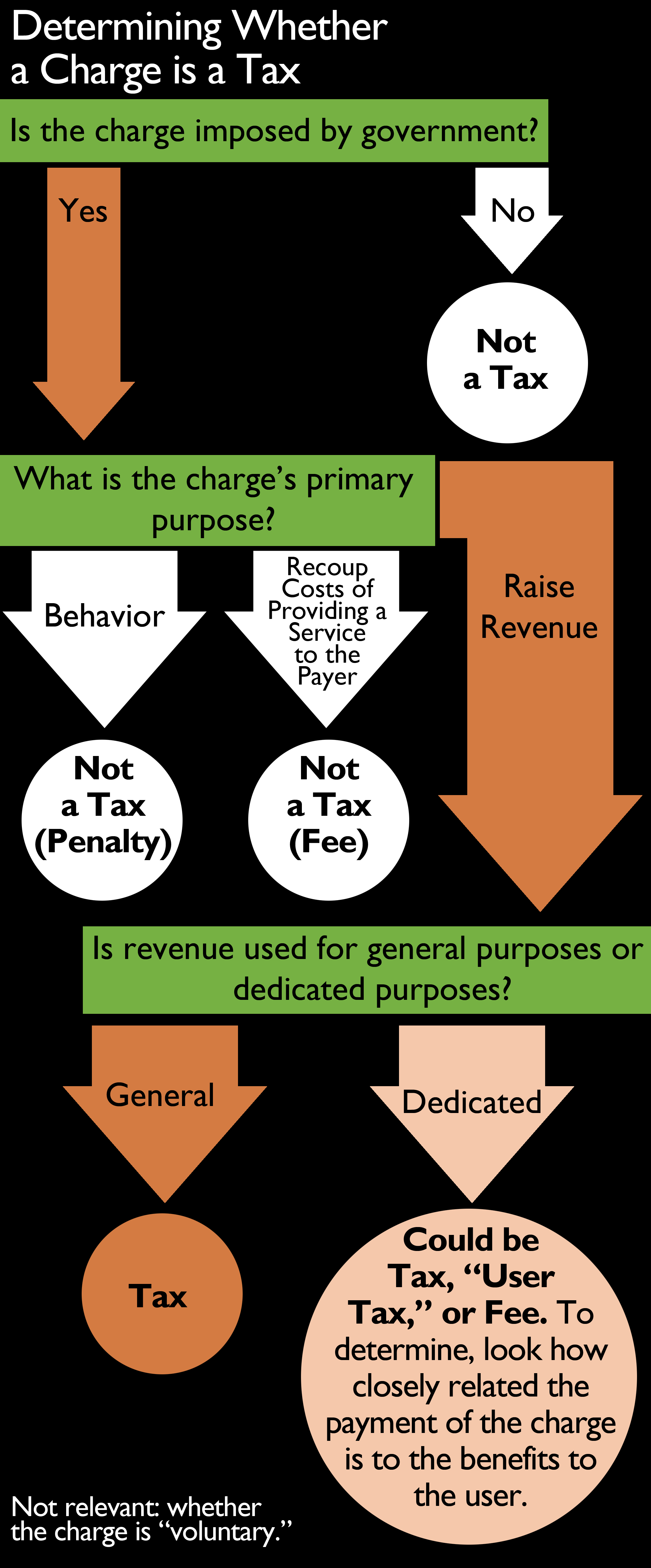

While 65 cents of every dollar pays for prizes and administration, the rest is imposed by the government, pays for general government expenses, and does not specifically benefit the payor. That’s the classic definition of a tax, upheld in nearly every federal and state court. The North Carolina Education Lottery was passed by the Legislature, but not after multiple readings as would be required for a tax. The North Carolina Institute for Constitutional Law brought a legal challenge and we filed a series of briefs backing the argument: the Lottery is in part a tax.

The lower courts, including the Court of Appeals, focused on whether lottery tickets are “voluntarily” purchased. But, as our briefs pointed out, what matters is whether the charge is voluntary, not whether purchase of the service is voluntary. All payments of taxes and fees are to some extent voluntary, so such an argument would make nothing a tax. Similarly, arguments that the 35 percent are “profits” beg the question, as the ultimate destination of that money in the state budget mean an effective 100 percent tax on lottery “profits.”

Ultimately, the case got up to the North Carolina Supreme Court which deadlocked in a 3 to 3 tie. That meant the Lottery lived and the legal issue remained technically unresolved. But the assessment was imposed by the North Carolina state general assembly, not a narrowly focused regulatory body; the assessment is paid by a broad swath of the public, not by a narrow group that benefits from a particular government service; and the revenue is spent on public education, a broadly available benefit, not on a single industry or similarly narrow group. All these facts argue for defining the lottery’s net revenue as tax revenue, not as a fee or profit or other miscellaneous charge.