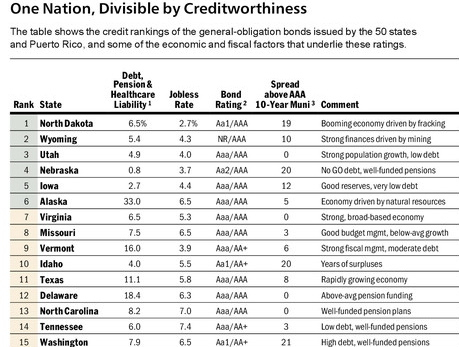

The latest Barron’s cover story focuses on a new ranking of states’ creditworthiness. Among Southeastern states, only Virginia (No. 7) ranks higher than North Carolina at No. 13. That’s the good news. The bad news? The ratings from Eaton Vance had North Carolina slated at No. 4 last year.

The latest Barron’s cover story focuses on a new ranking of states’ creditworthiness. Among Southeastern states, only Virginia (No. 7) ranks higher than North Carolina at No. 13. That’s the good news. The bad news? The ratings from Eaton Vance had North Carolina slated at No. 4 last year.

This year’s top three states are all located in the West.

THE TOP THREE STATES aren’t necessarily tops in the two categories shown in the table. In fact, North Dakota is 14th nationally in the debt, pension, and health-care measure.

Delahunty says that North Dakota is a prime example of why it’s important to look beyond the debt, pension, and health-care total. The state has the lowest unemployment rate in the country, 2.7%, thanks to an energy boom, and it has had the highest economic-growth rate of any state over the past three years. North Dakota also has a large cash pile—enough to fully fund its pension plan and still have ample liquidity left over.

Wyoming has a healthy economy, minimal debt, the lowest tax burden of any state, and a large cash hoard, sufficient to support its budget for four years. And, Delahunty says, the state could fully fund its pension plan with a modest contribution from its rainy-day fund.

Wyoming Gov. Matt Mead emphasizes the importance of pension funding. “If I were a company moving to a state, I would want to know how those pension plans are doing because I wouldn’t want to make a 20-year commitment to a state that’s going to raise taxes because they’re underwater on their pension plans,” he tells Barron’s.

With no state income tax, Wyoming is an anti-California—and it plans to stay that way. “I think it’s very tempting sometimes to raise taxes if you want to raise revenue. But when I’ve seen the economic development we’ve had in the past 3½ years, I’m telling you, it’s a huge deal to have the lowest taxes in the country,” Mead adds.

Utah has little debt and makes ample annual contributions to its pension plan. The state also has one of the lowest jobless rates in the country and the second-highest median household income, adjusted for the cost of living, behind Virginia.

Despite Utah’s sterling credit quality, Gov. Gary Herbert argues that there’s room for improvement, such as cutting the state’s modest debt of $2.6 billion. “It’s just a little bit high. Either way, we’re one of only nine states with a triple-A bond rating [from all three main rating agencies]. So we’re in pretty good shape. I just want to make sure we don’t jeopardize that.”