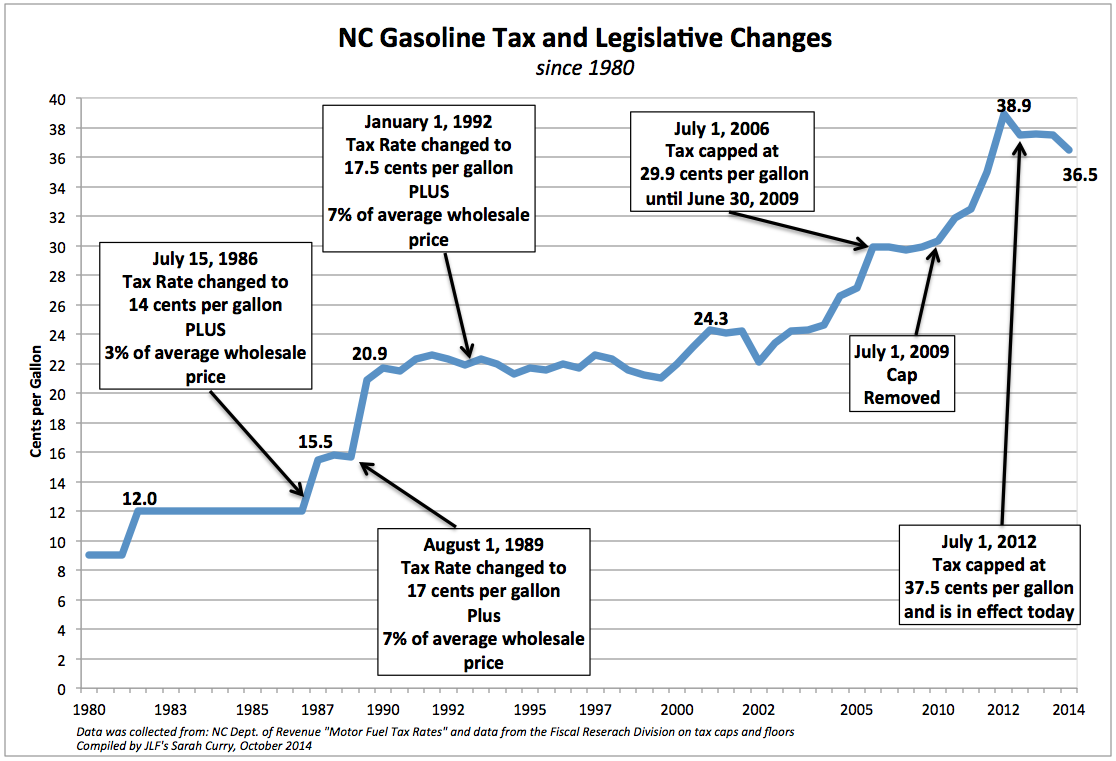

How high is the gas tax in North Carolina? Well, for starters, lets go back to 1980 when the tax was only 9 cents per gallon. If we adjust that for inflation, that is 26 cents today.

Today the state’s gasoline tax is 36.5 cents per gallon. The difference between 1980 and today in real terms is 10.5 cents per gallon, that’s a real increase of 40%.

In 1986, the legislature decided to move away from a flat excise tax and add a variable portion to the tax. Today, North Carolina’s gas tax is calculated with a flat rate of 17.5 cents plus 7% of the wholesale rate of gasoline.

While the legislature decided to cap the gas tax in 2006, it really hasn’t saved the taxpayer that much at the pump. Since January 1st 2014, the cap has only saved taxpayers 0.03 cents per gallon at the pump.

Below is a graph showing the gasoline tax since 1980. I point out the major legislative changes that have had an impact on the gasoline tax. The last time the gas tax rate was changed was in 1992. The first cap was imposed in 2006, and when it expired, the tax rate was at 29.9 cents per gallon. By the time the next cap was enacted, the rate had risen to 37.5 cents per gallon, a 7.6 cent increase. The gas cap that is currently in place will be a topic of debate during the 2015 legislative year because it is set to expire on June 30.