North Carolina state law mandates a revaluation of property every eight years, although many counties have decided to revaluate on a more frequent basis. Catawba County has adopted a four-year revaluation cycle and the last revaluation was in 2011. The new revaluation will become effective Jan. 1, 2015.

Properties appreciate and depreciate in value depending on a number of things. The nation saw a large difference between tax values and property valuation during the most recent housing bubble and the 2008 recession. According to data already collected, the county’s tax administrator said the overall property values are going to decrease when the new valuations are set, but its still early in the process.

An article about the revaluation states,

A public hearing will be held in Newton on Oct. 6, followed by a vote for formal adoption on Oct. 20. Property owners will have 30 days from the assumed Oct. 20 adoption to challenge the schedule of values. Appeals must be made to the North Carolina State Property Tax Commission on the grounds that the schedule of values will produce property values that are too high, too low or inconsistent.

New valuation notices will be mailed to property owners in early December.

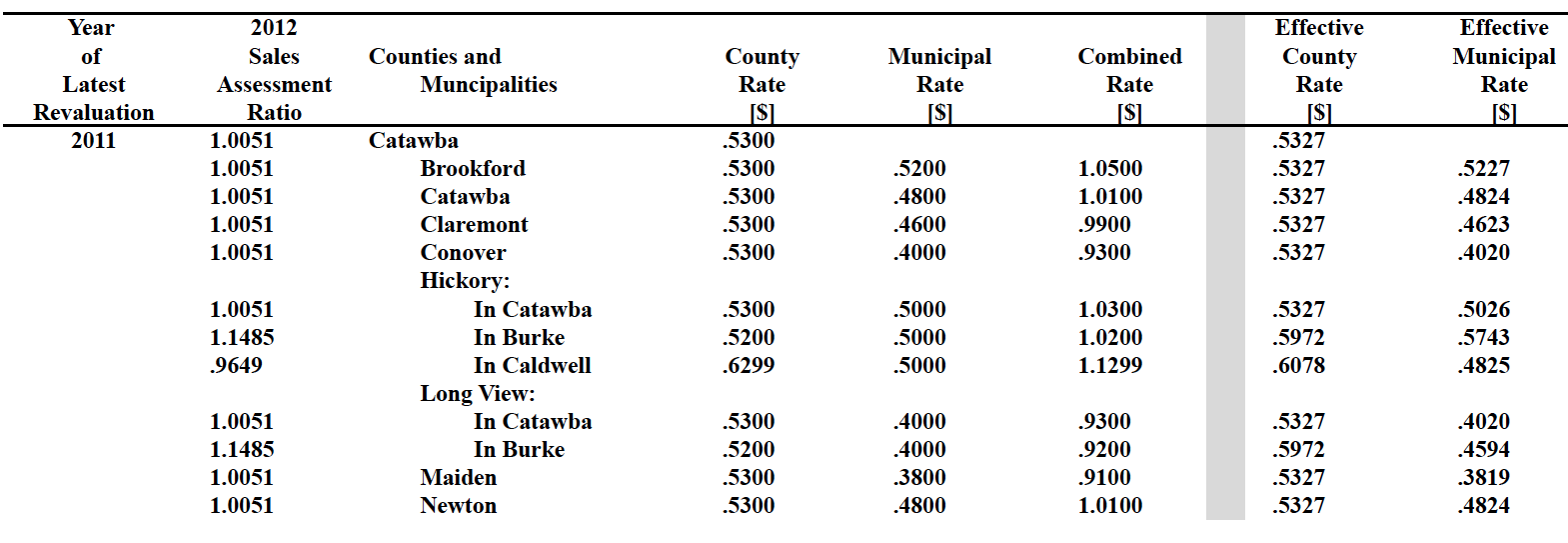

Here is a chart of the current property tax rates in Catawba County and the municipalities located in the county.