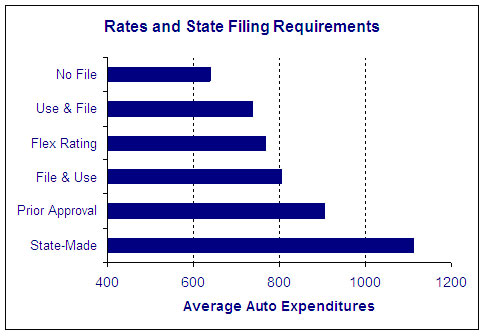

North Carolina’s automobile insurance market is heavily regulated. What does that mean to North Carolina drivers? More price regulation means higher cost to consumers. ACI offers a good explanation and argument for less regulation which the chart below illustrates. It was written in 2008 and unfortunately is still true today. Since 2008, JLF also has researched, written, explained, and discussed, how automobile insurance regulations hurt North Carolina consumers. We know burdensome state regulations result in negative economic effects. Some leaders in the General Assembly have even introduced legislation to address the problem. Perhaps it’s time to seriously consider reforming North Carolina’s automobile insurance system. 2015?