We learned this week that North Carolina offered the mad bribe of $107-friggin’-million in economic incentives to get Toyota to locate its North America headquarters in Charlotte, but lost.

Who won? Texas, with the relatively small bid of $40 million.

How on earth did North Carolina, offering over two-and-a-half times as much as Texas in incentives, lose to Texas? Some of it had to do with getting direct flights to Japan, but there was a bigger reason. Let Commerce Secretary Sharon Decker explain what happened:

Decker told the Observer that Texas’ low taxes meant the state didn’t have to offer as big an incentives package as North Carolina to be competitive.

“We were competing against a state without personal or corporate income taxes,” she said. “It’s a challenging competitive situation for sure.”

Could it be? Are we finally getting to the point where state leaders recognize the one glaringly obvious lesson buried in plain sight in the economic-incentives rationale? If a lower corporate tax rate for one industry would be attractive to the industry, then a lower corporate tax rate for every industry would be attractive to every industry.

What we need is the “all-comers economic incentive package” of eliminating the corporate income tax completely. Decker’s revelation would seem to appreciate that.

If a Texas-sized incentives package can’t beat out Texas because of its greater tax freedom, then maybe all the peer-reviewed research hullabaloo about lower tax rates being correlated with stronger economic growth is actually on to something!

Decker is in the news again this week, by the way. Here is what else she is involved in:

Pressure is building for Gov. Pat McCrory to call lawmakers back to Raleigh for a special session to pass economic incentives measures aimed at sealing the deal with companies considering North Carolina.

Top economic development and business officials on Wednesday joined Commerce Secretary Sharon Decker in calling for a special lawmaking period this year. Decker told the N.C. Economic Development Board at its meeting in Raleigh that job recruiters are “in a difficult spot” after the General Assembly’s failure in its just-ended session to add more money for Job Development Investment Grants and create a special, flexible fund aimed at closing deals in the latter stages of negotiations with companies.

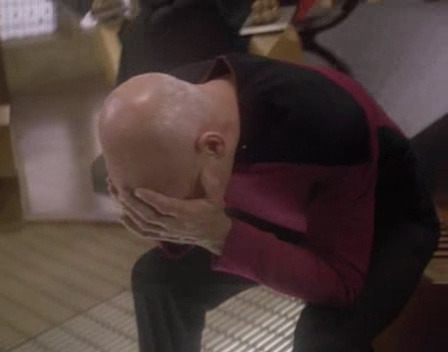

What we have here is a Texas-sized blind spot.

Criminy.

Sure, we can’t compete with Texas because we have personal and corporate income taxes and they don’t. The solution is obvious, isn’t it? Even bigger incentives packages!

This week’s news is why I called Decker’s approach the “Dig UP, stupid!” approach to economic growth.

Previous entries in “Drawing the Wrong Conclusion”: I, II, III, IV, V, VI, VII, VIII, IX, X, XI, XII, and XIII.