Allan Sloan writes in the latest Fortune magazine that the transformation of former Fed chairman Paul Volcker’s proposed financial reform into a government “rule” represents “a triumph of complexity over common sense.”

Allan Sloan writes in the latest Fortune magazine that the transformation of former Fed chairman Paul Volcker’s proposed financial reform into a government “rule” represents “a triumph of complexity over common sense.”

Great sound bites often make for bad policy, because things that seem wonderful and simple in the abstract frequently turn out to be hideously complicated when you try to apply them in real life. That’s my takeaway from the Volcker Rule, which was unveiled in mid-December after five different federal financial regulatory agencies — another example of real-world complexity — finally signed off on it.

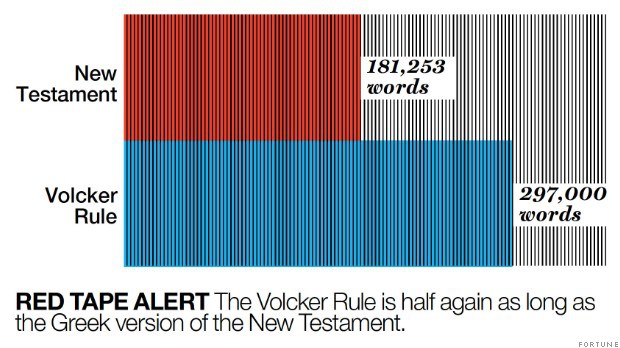

The rule has 71 pages, which is a lot of words to transform former Fed chairman Paul Volcker’s simple-sounding proposal into law. His idea, as you probably know, was to ban big financial institutions from putting taxpayers at risk by using federally insured deposits for securities speculation. But the rule itself is only the start of the complexity. It comes with an 892-page explanation. Combine the two parts and you have an opus half again as long as the New Testament, and one that to regular people might as well be written in the original Greek.

In the real world, the longer and more complicated something is, the more difficult it is to enforce and the more opportunities there are to game it. When you’ve got 297,000 words of text (by the count of the Davis Polk & Wardwell law firm), you’ve got loads of lurking loopholes.