If the Dodd-Frank financial regulations and Obamacare haven’t given you enough of a clue that an overly large government leads to overly complicated government rules, the latest Bloomberg Businessweek offers another example for your consideration.

If the Dodd-Frank financial regulations and Obamacare haven’t given you enough of a clue that an overly large government leads to overly complicated government rules, the latest Bloomberg Businessweek offers another example for your consideration.

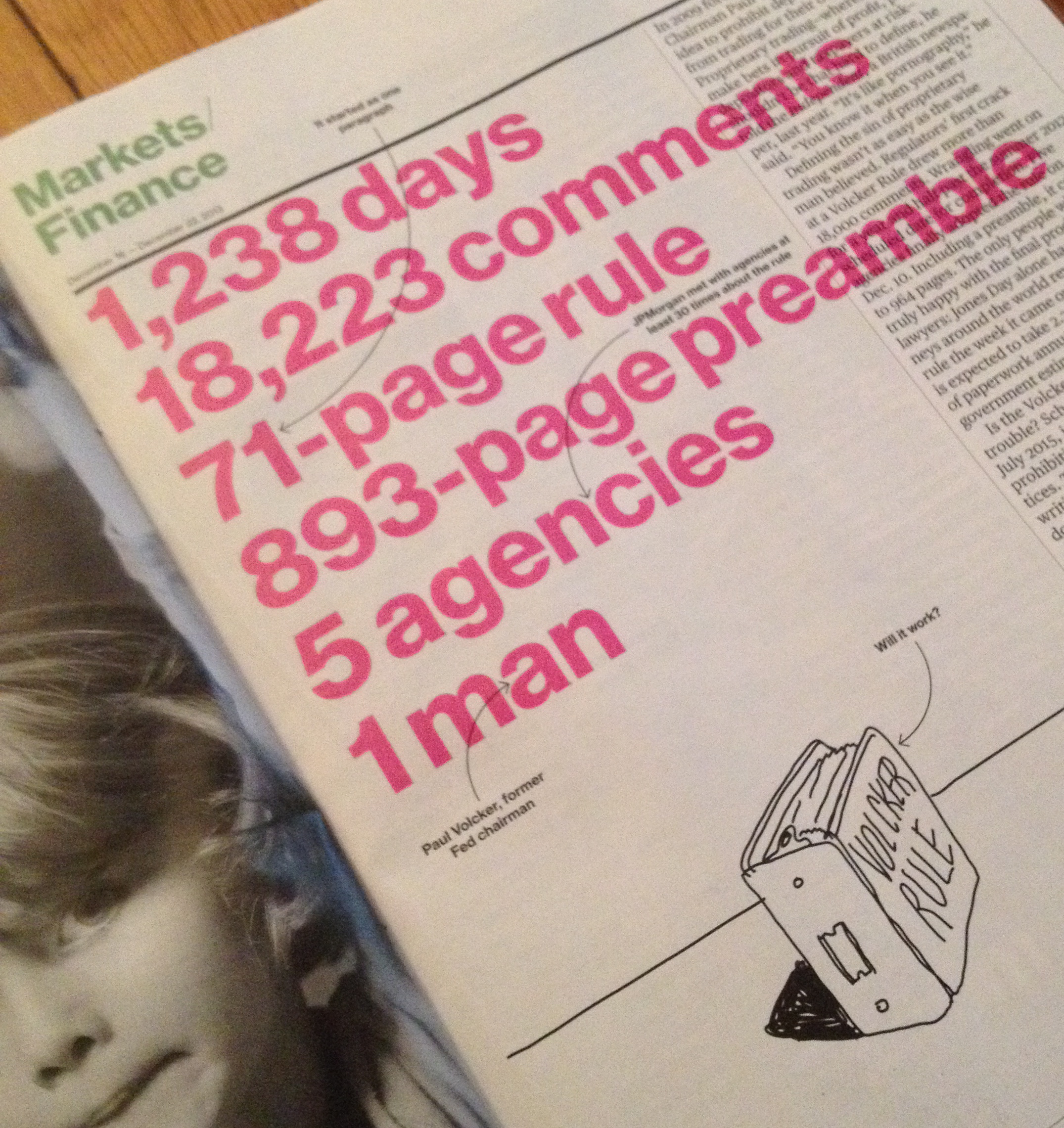

In 2009 former Federal Reserve Chairman Paul Volcker had a simple idea to prohibit deposit-taking banks from trading for their own accounts. Proprietary trading—wherein banks make bets in pursuit of profit, putting depositors and taxpayers at risk—shouldn’t be that hard to define, he told the Independent, a British newspaper, last year. “It’s like pornography,” he said. “You know it when you see it.”

Defining the sin of proprietary trading wasn’t as easy as the wise man believed. Regulators’ first crack at a Volcker Rule drew more than 18,000 comments. Wrangling went on for a year and half past the summer 2012 scheduled date for completion. Five agencies finally adopted the rule on Dec. 10. Including a preamble, it comes to 964 pages. The only people who seem truly happy with the final product are lawyers: Jones Day alone had 200 attorneys around the world reviewing the rule the week it came out. Compliance is expected to take 2.3 million hours of paperwork annually, according to government estimates.