Most discussion of the new federal health care law has focused — no big surprise here — on health, or at least on insurance related to health. Kevin Hassett of the American Enterprise Institute devotes his latest column in the print edition of National Review to another important aspect of Obamacare; its impact on the labor market.

As important as the law’s effect on health care markets will be, we should not continue to ignore its effects on the labor market. These are likely to be large. Casey Mulligan, an economist at the University of Chicago, has recently documented an important untold story about the Affordable Care Act: It is a historically large disincentive to

work.

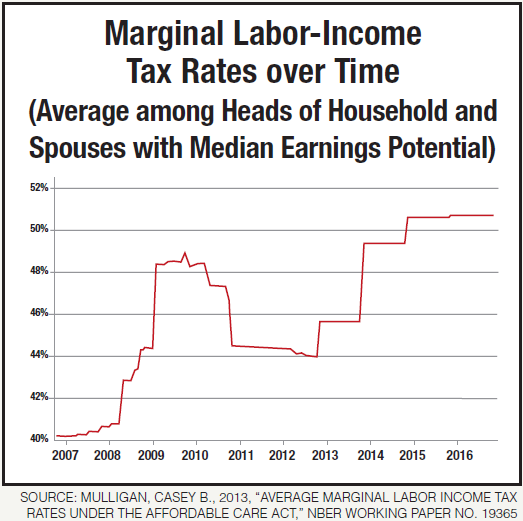

The nearby chart shows Mulligan’s estimates of the marginal tax rate on labor income by year for the median nonelderly person filing as a head of household or spouse. Mulligan’s calculations are quite thorough and factor in the benefits that a nonworking person loses if he decides to work. For example, if he gets $50 a week in food stamps while unemployed but loses them when employed, then the benefit of working is $50 per week lower than it otherwise would be.

Mulligan performs the calculations for a hypothetical person who in 2007 made about $790 per week (the median wage in that year for a non-elderly household head or spouse who was working). As is clear in the chart, the marginal tax rate on labor income increases by about four percentage points in 2014 alone, with an increase of about one percentage point the following year. This jump is due to certain provisions of the ACA that go into effect in 2014 and 2015, such as the employer-mandate penalties, health-care exchanges, and subsidies.

Mulligan discusses a number of examples that illustrate the channel through which taxes are increased. If a worker is part-time and does not receive insurance from his employer, he is eligible for premium support from the government. If he works harder and becomes a full-time employee, then he can lose this subsidy and his extra labor is therefore implicitly taxed. If he were to work fewer hours per week—say, moving from 35 to 29 hours per week—he might make slightly less money, but he would be eligible for the health-care subsidy if he lost employer insurance, and he would have more leisure time. Mulligan finds that workers may often be able to increase their after-tax income by working less.