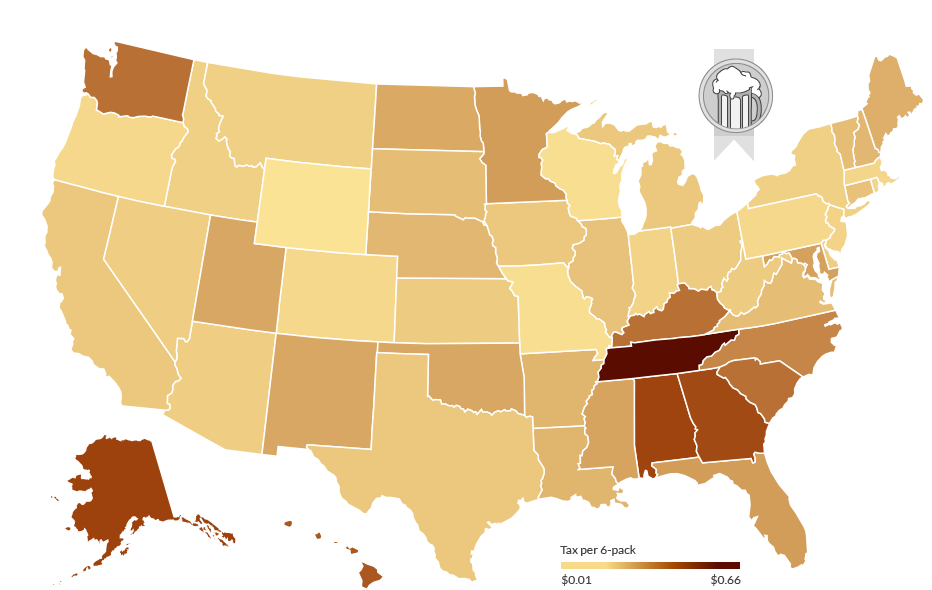

With all the talk about tax reform, many legislators have been comparing North Carolina to neighboring states. One neighbor stands alone in the country when it comes to a certain tax, beer excise taxes. Tennessee is ranked #1 for the highest beer excise taxes in the country. The lowest ranking state is Wyoming.

CNN Money did a report on beer taxes today showing how much each six-pack of beer is composed of taxes, depending on the state. If you want to learn more about North Carolina’s excise taxes, find my report here on all of North Carolina’s excise taxes. Click on the graphic below to see an interactive map of all the states and their beer taxes. Here is a small excerpt from the article:

Tennessee, which happens to be the heart of whiskey country, claims the top spot, due to combined excise and wholesale taxes that push the tax burden for consumers to $1.17 per gallon, or 66 cents per six pack, according to the Tax Foundation’s analysis of beer-specific statewide taxes. In contrast, the state’s taxes on spirits — including whiskey — rank 30th in the nation.

Other states with the highest beer taxes include Alaska ($1.07 per gallon), Alabama ($1.05) and Georgia ($1.01), which charge more than 50 cents in taxes on a six-pack.

Meanwhile, the lowest taxes are in Wyoming, a generally tax-friendly state which levies only two cents in taxes on a gallon of beer or one cent per six pack. Other low beer-tax states include Wisconsin and Colorado, the respective birthplaces of Miller and Coors brews.