Nearly 45 million Americans today are 65 or older. By 2040 that number is projected to approach 80 million. Many of those nearly 80 million people will be relying at least to some extent on federal entitlements.

Nearly 45 million Americans today are 65 or older. By 2040 that number is projected to approach 80 million. Many of those nearly 80 million people will be relying at least to some extent on federal entitlements.

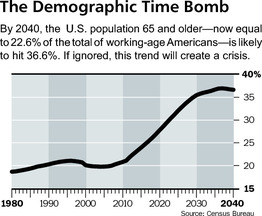

And those aren’t the only numbers Gene Epstein turns to in his latest “Economic Beat” column in Barron’s to argue the U.S. must do something now to address its government deficits and debt. Epstein highlights the chart to the right.

It tracks the number of Americans 65 and older as a percentage of the number of working-age Americans, 18 to 64. This year, the share is 22.6%, up from 18.7% in 1980. By 2040, it will have soared to 36.6%.

Put more starkly, according to these percentages, there are now 4.4 people of working-age potentially supporting each senior citizen. By 2040, each senior citizen will be potentially supported by just 2.7 working-age individuals. I say “potentially” because we don’t know how many 18-to-64-year-olds will actually have paying jobs and thus be directly contributing to government support of the seniors. We do know that, to compensate for the plummeting ratio of the working-aged to seniors, the labor-force participation rate would have to rise to a degree too extreme to be taken seriously.

The aging of America is the key reason the deficit-deniers can’t be taken seriously. Those who deny that debt and deficits should be dealt with now point out that budget projections for the next 10 years don’t look especially worrisome. But instead of viewing this relatively brief breathing period as an opportunity to prepare, they regard it as an excuse to delay.

Ironically, the Congressional Budget Office, the source the deniers generally use when they cite numbers, is the same agency that has warned of rivers of red ink when elder-care dependency reaches critical mass around the mid-2020s. In its February report on the 10-year outlook through 2023, the CBO declared that “projections for the period covered in this report do not fully reflect long-term budgetary pressures,” adding that “debt will rise sharply relatively to GDP after 2023.” That’s why the agency proposed “deciding now what policy changes to make to resolve that long-term imbalance….”