In his recent speech in Roanoke, Virginia, President Obama has once again renewed his commitment to a balanced approach to shrinking the federal government’s fiscal deficit.

So I’m going to reduce the deficit in a balanced way. We’ve already made a trillion dollars’ worth of cuts. We can make another trillion or trillion-two, and what we then do is ask for the wealthy to pay a little bit more.

This sounds reasonable until it’s given proper context. In his continual call for the rich to pay more taxes, the president neglects to mention that America’s top earners already pay more in taxes than anyone else in the country–both as a percentage of income and as a percentage of total federal taxes collected.

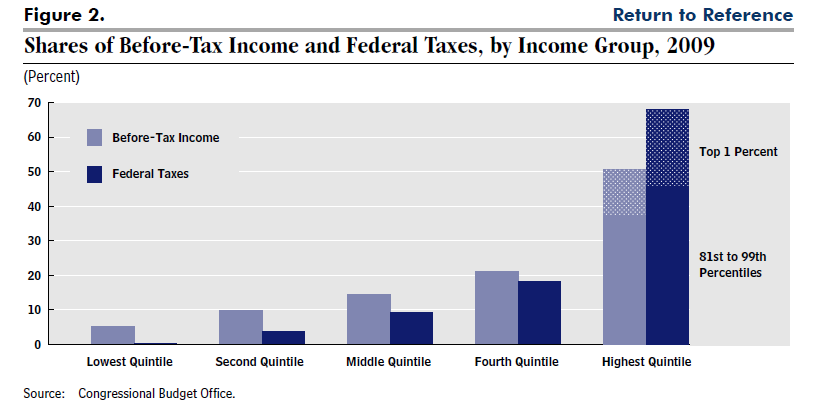

According to the Congressional Budget Office, in 2009 the richest 1 percent of American households earned 13.4 percent of the country’s income, but paid 22.3 percent of all federal taxes.

Furthermore, as the CBO’s graph below shows, the top 20 percent of earners pay a far greater share of federal taxes than their share of the country’s income seems to warrant.

As you can see, the top 20 percent of taxpayers are the only fifth whose share of the federal tax burden outweighs its share of national income. To suggest, as the president later did in his speech, that successful Americans are freeloading off the rest of us–that they don’t pay their “fair share” of taxes–is absurd.

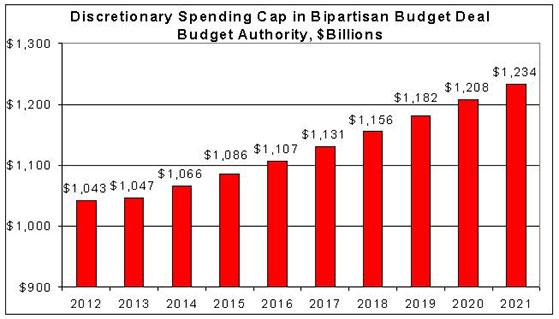

Of course, President Obama also pointed out that Washington has cut $1 trillion in spending. Unfortunately that doesn’t actually amount to much. Here’s what the the federal government’s limit on discretionary spending looked like after $917 billion in “cuts” last summer:

Spending will still rise, just not as fast as it otherwise would. Within the Washington Bubble, this qualifies as a massive spending cut. It’s cold comfort to know that, as Sen. Rand Pual put it last August, we’re now heading for the fiscal cliff at 60 mph rather than 80 mph.

The claim that only a balanced approach–spending cuts and tax hikes–can solve our debt crisis is extremely misguided. Proposals like these sound reasonable to those unfamiliar with politicians’ fiscal trickery, but in reality “balanced” approaches combine growth-dampening tax hikes with spending cuts that never materialize.

When it comes to getting a handle on the national debt, balanced approaches don’t work. The United States’ massive debt is the product of too much spending, not too little revenue. Until the federal government gets its spending problem under control, there’s simply no way increased taxes can help eliminate the deficit.